With the market in a correction, the best place to be is in cash. Take this time to research past trades and see what went wrong and were you went right. Currently, I’m reviewing every Earnings Surprise for 2010 and see how these stocks behaved in the weeks and months after their release.

So how did we get here in the first place and what were the signs telling us to move to cash? While we have a time, let’s look at the trusty market monitor (developed by Pradeep Bonde at Stockbee.biz) and review the warnings signs and know what to look for over the next few weeks.

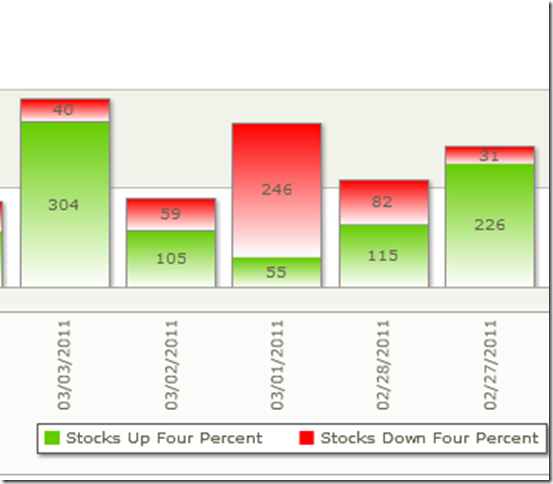

Trouble started on 2/22/2011 with a big 600 plus down day on our daily breadth indicator. This is where you tighten stops and start taking profits while you have them.

We then saw a series of 200 plus days. At this point I was thinking the market would turn and head higher as it did over the previous weeks.

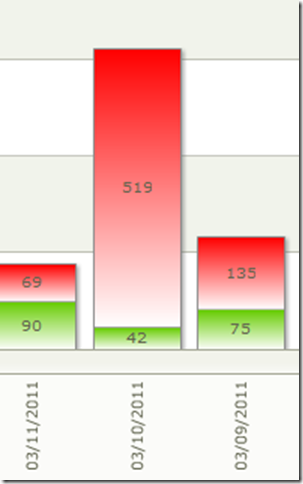

The next week, the market resumed it’s down trend taking out any remaining stops.

Right now, we’re playing the waiting game. Until the market shows several days of serious accumulation do not step in. How do we know when this occurs? We watch the Daily Breadth indicator – Stocks up 4% or greater as well as the Primary Indicator; stocks up/down 25% in a quarter.

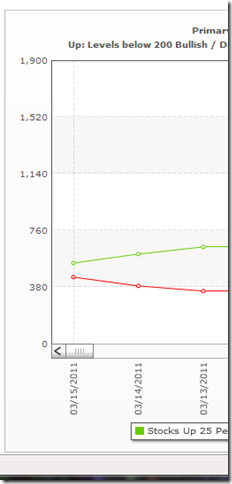

For now, the primary indicator is barely in bullish mode. One large down day from here and we can possibly be looking at a longer term correction. (Green line crosses under Red line).

The last time we saw a bearish cross (red, stocks down 25 or more in a qtr, over green, stocks up 25% or more in a qtr) over on the primary breadth indicator was May thru July 2010.

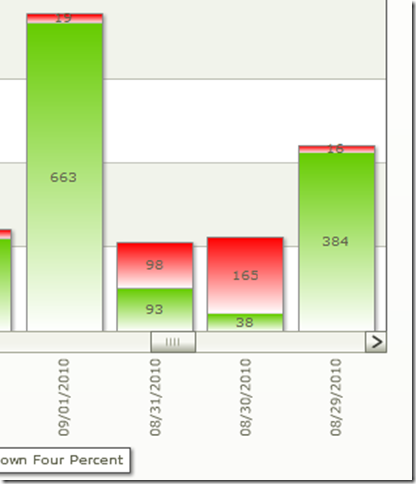

Towards the end of August 2010, we saw consecutive breadth thrusts that triggered the start of the rally through February. After a healthy correction, this is where the best opportunities can be found for swing and position traders.

This is what we’re looking for; several days were the market is decisively being bought. Until then, we do our research, maintain our watch lists and stay out of trouble.

You can view the historical market monitor charts here: http://www.patientfisherman.com/mm/

These charts can also be accessed by clicking the “Market Monitor” link in Bluefin.

1 Response to The Waiting Game

Just want to say nice work on the MM charts. They looks great and makes it easy to follow.

Thanks DC

Post a Comment