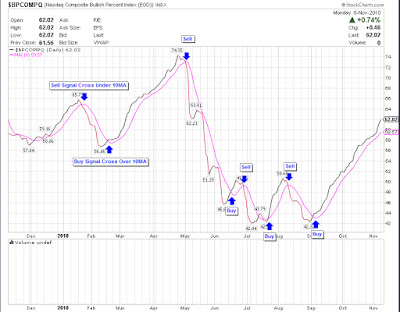

With the new market monitor charts up and running, it's a little easier to see how breadth was deteriorating over the past few months. While we're waiting for the markets to stabilize, now seemed like a good time to walk through the past six months. See charts here.

I've taken the Primary Breadth Indicator from the Market Monitor chart and added a chart of the spx so you can see how they work together. (Market Monitor was developed by Pradeep Bonde at StockBee.biz)

Back on August 30th, the market was coming out of a multi-month correction with a bullish cross over on the primary indicators. Not withstanding a few minor corrections along the way, September through the end of December was an ideal trading period for swing and position traders.

Breadth steadily increased and maintained its strength through December. Even when the SPX touched the 50 period ma in November, breadth remained strong and the market rallied higher from that point.

In January, things began to take a different tone. As the market made new highs, breadth started making new lows. And as many people have told me there was still money to be made during that period. You can make money in any type of market, the difference is, leadership was narrowing and our trades have to be more specific to the sectors that were working. Otherwise, breakouts were more likely to fail.

As breadth is increasing, the number of stocks that will likely follow through is higher, as breadth is decreasing breakouts are more likely to fail. Sticking with the very top sectors can keep you in the market longer but eventually something has to give. You can equate it to standing on a strong base made of rock versus standing on thin sheet of ice that can crack any moment.

As you can see, the market was flashing warning signals weeks in advance of this decline. It's up to you to figure out how to interpret that data and act on it.

In short, Market Breadth Indicators tell us the underlying strength of the market or any given index. Stockcharts.com describes the Bullish Percent Index as:

The Bullish Percent Index (BPI) is a breadth indicator based on the number of stocks on Point & Figure buy signals within an index. Because a stock is either on a P&F buy or sell signal, there is no ambiguity when it comes to P&F charts. This makes BPI a straightforward indicator with clearly defined signals.

Basically, you are watching for the daily index line to cross over or cross under the 10 day moving average. When the you get a cross above, you would move in to the market, cross under you move back into cash.

You can watch the indicator for all of the major indexes:

$BPCOMPQ - Nasdaq

$BPNYA - NYSE

$BPSPX - S&P 500

$BPINDU - Dow

I attempted to create the Hindenburg signal in StockFinder. It looks like we are getting clusters of signal around the correct dates but it still needs some fine tuning. It's up on StockFinder under "PatientFisherman_HindenburgBeta".

Since we have been covering general market indicators over the past few weeks and the media has been giving the "Hindenburg Omen" some attention, I wanted to post some quick details on what it is and how it works.

One note; Any one using the Stockbee Market Monitor is already in cash or short. Our trading behavior over the next few weeks should not change based on any media speculation or hype. It’s business as usual.

According to Market Breadth Indicators by Gregory L. Morris,

Jim Miekka provided a significant indicator of market danger. The Hindenburg Omen is a sell signal that occurs when NYSE new highs and new lows each exceed 2.8 percent of advances plus declines on the same day. In addition, the NYSE index must be above the value it had 50 trading days (10 weeks) ago. Once the signal has occurred, it is valid for 30 trading days. During the 30 days the signal is activated whenever the McClellan Oscillator (MCO) is negative, but deactivated whenever the MCO is positive.

I didn't have much luck recreating the indicator in StockFinder, but I did find some detailed information over at Stockcharts.com. According to Chip Anderson from Stockcharts.com we have had an "unconfirmed" signal.

How to interpret the charts:

http://blogs.stockcharts.com/dont_ignore_this_chart/2010/08/hindenburg-omen-tracking-chart.html

Live chart:

http://stockcharts.com/h-sc/ui?s=$NYMO&p=D&b=5&g=0&id=p20489603975

We have examined a few breadth indicators over the past few weeks, but you can also use a simple concept such as moving averages to get you in and out of the market. Ideally, the best system would use a combination of market breadth and trend to indicate the prime trading zones. For instance, you could apply this moving average concept with a breadth thrust signal to support the signal.

This indicator uses three simple moving averages; 5 period ma, 10 period ma, and 20 period ma. When the moving average are in proper positions 5 > 10 > 20 you get an entry signal. I've also applied my standard 5 ma < 10 ma as an exit parameter. You could use this signal to tighten stops on all positions and/or take profits.

The green up arrows would indicate the trading zones, while the red down arrow would be an exit alert.

This is not an indicator I use on a regular basis but I was looking for a concept I could easily illustrate to people who were curious about market timing.

You can find the shared layout in StockFinder under "PatientFisherman_3TrendSignal".

There is mention in William O'Neil's , How to Make Money in Stocks. He states that an impending up turn in the market occurs, after a decline of 10-12 percent, while the market continues to drop, the upside/downside volume starts to shift.

Zweig states a ratio of 9-to-1, with two signals in any 3-month perod, suggests a strong market to follow.

You can grab this shared layout in StockFinder, PatientFisherman_Upside_Downside_Vol.

* Ratio of positive numbers will always yield postive numbers.

Reference: Market Breadth Indicators, Gregory L. Morris

[Edit 06/20/2010]

I went ahead and added an indicator for Breadth Thrust Continuation - "..signal is given whenever it goes above 0.615 without the requirement for it to come from below 0.40 in 10 days."