If you’ve been unfortunate enough to catch any of the commentary on the 24 hour news networks over the weekend, you are probably expecting the apes to take over and life as we know it to never be the same. The best thing you can do is turn off the noise.

None of this is under your control. Following the pundits minute by minute will make your head spin. What is under your control is how you position yourself in the market using tools such as the Stockbee Market Monitor and the Bullish Percent indexes.

Using these tools we have been able to move into cash well in advance of the decline we experienced this past week. These indicators helped us successfully navigate through the last bear market and they will successfully navigate us through this decline.

Current State of Market Breadth

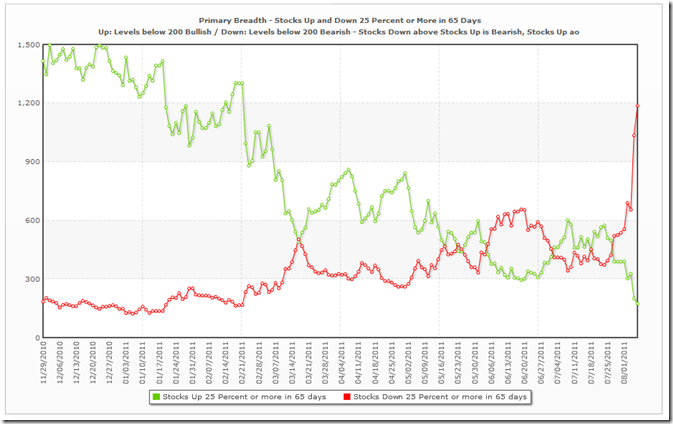

No surprise here, we had some big selling days on the daily breadth indicator. July 27th showed the first signs of trouble with 622 stocks down on our daily breadth indicator.

On July 27th, we had a bearish crossover on the Primary Breadth Indicator telling us to move into cash on all accounts.

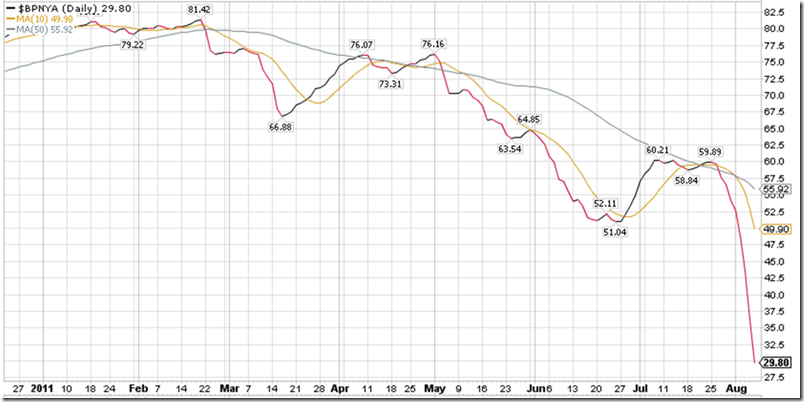

Our Bullish Percent Indicator turned bearish on July 27th confirming the weakness in breadth across our indicators.

What to Look For

At this point, we need several strong days to the upside to turn momentum back up in this market. The market is oversold, but oversold levels can last for weeks. Anticipating the next move can lead to death by a thousand cuts. A good way to slowly grind your account down. Several 500+ days on the daily breadth indicator will signal a turn in the market. Wait for confirmation on the primary breadth indicator and bullish percent indexes. Until we see that confirmation, cash is king.

Do yourself a favor and focus on the tools you have at your disposal to navigate this market and turn off your television.

No Response to "Debt-ageddon 2011"

Post a Comment